When I wake up unusually early and can't go back to sleep, do you do the same thing I do? I sit in front of my laptop which I've left turned on overnight. I normally open facebook, check emails, then browse for things to read from 4 to 6am in the morning.

This morning I also visited bpiexpressonline to check how much money I have left. My attention was caught by the splash ad of financial advisor Suze Orman. So I click.

I read about Suze Orman and watch her interview with Karen Davila on ANC. I instantly like Orman, and her high pitched voice in contrast to Davila's croaky one.

To sum up Suze's message it is: Live below your means, save and invest regularly

The advice is sound. But for an entrepreneur homeschooling mom like me, it's not enough. Why?

Because I cannot change my lifestyle to a more luxurious one. By ratio and proportion, the money I would be able to save will only be enough to pay for a poor to average lifestyle.

Suze's advice is nothing new, you will read and hear about this over and over again from other financial gurus. And sometimes your own mother. If I follow this advice, it means:

Provided my lifestyle doesn't change. The lifestyle of living below my means. A limited lifestyle. What if I want to retire rich? What if I want to enjoy the finer things in life? What if I want to travel the world, eat in 5 star hotel buffets, enjoy a good spa and have airconditioning turned on in my house 24/7? Then the above advice, inspite of its logic, just doesn't cut it for me.

I read about Suze Orman and watch her interview with Karen Davila on ANC. I instantly like Orman, and her high pitched voice in contrast to Davila's croaky one.

To sum up Suze's message it is: Live below your means, save and invest regularly

The advice is sound. But for an entrepreneur homeschooling mom like me, it's not enough. Why?

Because I cannot change my lifestyle to a more luxurious one. By ratio and proportion, the money I would be able to save will only be enough to pay for a poor to average lifestyle.

Suze's advice is nothing new, you will read and hear about this over and over again from other financial gurus. And sometimes your own mother. If I follow this advice, it means:

- I live below my means so I save some money.

- I accumulate enough money to invest in income-earning mutual funds

- After 30 years, I can retire by living on the interests of my investments provided my lifestyle doesn't change.

Provided my lifestyle doesn't change. The lifestyle of living below my means. A limited lifestyle. What if I want to retire rich? What if I want to enjoy the finer things in life? What if I want to travel the world, eat in 5 star hotel buffets, enjoy a good spa and have airconditioning turned on in my house 24/7? Then the above advice, inspite of its logic, just doesn't cut it for me.

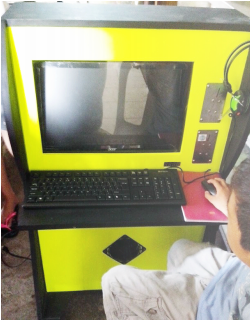

Pisonet with slots for P1 & P5 coin.

Pisonet with slots for P1 & P5 coin. My mind has to work constantly to come up with more than just living below my means. I must buy things that will generate passive income.

Things that generate income on it's own are assets.

Living below your means is easy. Here are some of the things I do:

Do the laundry only once a week. It saves on electricity, soap and fabricon.

No going to the movies. Unless sponsored by relatives or friends.

Use the aircon on timer - 3 hours at the most. And only at night so I can get a goodnight's sleep. Even better if you can stand the heat and not use an aircon all together. But for me, that's only possible in the latter months of the year.

Schedule activities to sync with other errands I can accomplish. If my kids need to go for a peer group activity, I would schedule my meetings, my husband's or bills payment at the same time. Saves on gas and toll.

Eat out on special occasions only. Like my kid's birthday. Since I have 4, that’s eating out 4 times a year. When we eat out, it's nothing fancy. It's usually fast food of their choice. I don't even eat out on my birthday or wedding anniversary.

No cable. I have an antenna, those indoor ones from CDR-King. But I don't really watch TV if I can watch it on my laptop using the internet.

Buy groceries only once a month on an 8 to 10K peso budget. I follow this strictly. I go every first Wednesdays of the month at Shopwise to get x10 points on my membership card. I'd get almost P1,000 rebate for the next month's grocery. If we are running short on food, I have to be creative to stretch it. Sometimes we just eat peanut butter or canned foods and pretend we are in an apocalyptic movie where we have to save every morsel of food. Worse comes to worst, I go to my mother's house to eat but this is very rare.

I homeschool my kids. If they were in a regular private school, which was the case 2 years ago, I would have spent P100,000 minimum on this year's enrolment alone for my three boys. Public school is not an option for me. Send my kids away for eight hours to actually only spend less than 4 hours of learning (if any)? No thanks. I choose homeschool which cost me P35,000 on enrolment - for three kids. Not a bad deal. I am with my kids, I see them grow and I know they are learning.

Things that generate income on it's own are assets.

Living below your means is easy. Here are some of the things I do:

Do the laundry only once a week. It saves on electricity, soap and fabricon.

No going to the movies. Unless sponsored by relatives or friends.

Use the aircon on timer - 3 hours at the most. And only at night so I can get a goodnight's sleep. Even better if you can stand the heat and not use an aircon all together. But for me, that's only possible in the latter months of the year.

Schedule activities to sync with other errands I can accomplish. If my kids need to go for a peer group activity, I would schedule my meetings, my husband's or bills payment at the same time. Saves on gas and toll.

Eat out on special occasions only. Like my kid's birthday. Since I have 4, that’s eating out 4 times a year. When we eat out, it's nothing fancy. It's usually fast food of their choice. I don't even eat out on my birthday or wedding anniversary.

No cable. I have an antenna, those indoor ones from CDR-King. But I don't really watch TV if I can watch it on my laptop using the internet.

Buy groceries only once a month on an 8 to 10K peso budget. I follow this strictly. I go every first Wednesdays of the month at Shopwise to get x10 points on my membership card. I'd get almost P1,000 rebate for the next month's grocery. If we are running short on food, I have to be creative to stretch it. Sometimes we just eat peanut butter or canned foods and pretend we are in an apocalyptic movie where we have to save every morsel of food. Worse comes to worst, I go to my mother's house to eat but this is very rare.

I homeschool my kids. If they were in a regular private school, which was the case 2 years ago, I would have spent P100,000 minimum on this year's enrolment alone for my three boys. Public school is not an option for me. Send my kids away for eight hours to actually only spend less than 4 hours of learning (if any)? No thanks. I choose homeschool which cost me P35,000 on enrolment - for three kids. Not a bad deal. I am with my kids, I see them grow and I know they are learning.

It's important to say that saving money was not the main reason I chose to homeschool. That was just a plus. You can read about what convinced me to homeschool here.

Most of the stuff I mentioned above are needs aka liabilities. Liabilities take money out of my own pocket – money that I earn from my professional income as a freelancer. Money from my active income.

Most of the stuff I mentioned above are needs aka liabilities. Liabilities take money out of my own pocket – money that I earn from my professional income as a freelancer. Money from my active income.

When I buy wants, the money cannot be taken out of my active income. Something else has to pay for it. That’s when I live below my means to save money. I save money to buy assets. Assets pay for my wants.

For example I want a new HMO. I could easily settle for Philhealth. But if I or my kids should get sick I want to be confined in a nice comfortable room. After looking around I realized getting a new HMO will cost roughly 2 thousand pesos a month.

Here's the plan to get this particular want:

1) We can cut electricity costs to be able save money up to 1,000 pesos. Since I am

already cutting costs on aircon, I guess I'll cut even more to having a no-aircon day.

2) Expand our income - get more projects done to save a bigger amount faster

3) Use the money saved to buy something that will generate passive income

The handyman and I have talked about buying a third computer unit - a pisonet - that we will add to his modest computer shop in the province (and I mean modest, you can see the photo below). We project that it will generate more or less 1,000 pesos a month net income. What's important is that it is 1000 pesos less to worry about.

What's great about buying an asset is that it continues to earn money for you even when you have stopped paying for your wants.

Of course there are things to consider like wear and tear, maintenance, and machines can break when other people use them. "Hassle!" you might say. But its a small price to pay in exchange for not having to work for money and having financial freedom. Is it worth the price for you?

Sure is for me. How do you live below your means? Share your thoughts by dropping a line or two in the comments section. If you haven't done it already, do subscribe on the right sidebar, it's free!

Here's the plan to get this particular want:

1) We can cut electricity costs to be able save money up to 1,000 pesos. Since I am

already cutting costs on aircon, I guess I'll cut even more to having a no-aircon day.

2) Expand our income - get more projects done to save a bigger amount faster

3) Use the money saved to buy something that will generate passive income

The handyman and I have talked about buying a third computer unit - a pisonet - that we will add to his modest computer shop in the province (and I mean modest, you can see the photo below). We project that it will generate more or less 1,000 pesos a month net income. What's important is that it is 1000 pesos less to worry about.

What's great about buying an asset is that it continues to earn money for you even when you have stopped paying for your wants.

Of course there are things to consider like wear and tear, maintenance, and machines can break when other people use them. "Hassle!" you might say. But its a small price to pay in exchange for not having to work for money and having financial freedom. Is it worth the price for you?

Sure is for me. How do you live below your means? Share your thoughts by dropping a line or two in the comments section. If you haven't done it already, do subscribe on the right sidebar, it's free!